What jobs are most likely to be cut in a recession?

Introduction

A recession is a period when the economy declines significantly and it takes several months to recover. Recessions are caused by severe events such as wars, natural disasters, and financial crises. Sometimes recessions are triggered by small shocks and sometimes they last for a long time.

In addition, if a company is experiencing a recession, the company will have to cut its workforce. This means that fewer people will be employed. This can mean fewer customers, less productivity, and slower growth. Companies usually lose money during a recession. If you are looking for a job, it is important to understand the implications of a recession on your career prospects.

Implications of recession on companies and job prospects

A recession does not necessarily mean that you will lose your job. It means that you may have to wait a little longer to find a new job. If your current company is experiencing a recession, it may be a good time to change jobs.

However, if your company is doing well, then you should try to find a job with the same company. It is a good time to negotiate a raise.

Moreover, in 2008-2009, the United States experienced a major recession. This was followed by a global financial crisis which has continued for three years. These events have caused large-scale job losses. According to the latest statistics, unemployment rates have been increasing throughout Europe and the US. The number of unemployed people has also risen substantially in many European countries and the United States.

In general, a recession causes a decrease in GDP and a decrease in employment. However, there are times when the number of jobs actually increases, although this is less common than a decrease. During a recession, most people cannot earn a living wage. Many companies close their businesses and layoff workers. Some may even shut down altogether. It is important to understand what a recession is and why it occurs.

Importantly, the following information will help you to understand this phenomenon. Recessions are caused by various factors. One of the biggest reasons is a sudden decrease in the amount of money that people are spending on goods and services. This can cause the overall economy to decline.

Factors that contribute to job loss during a recession

A recession occurs when there is a decline in the general economy of a country. In the past, recessions were characterized by high unemployment rates, and a decrease in the value of the national currency.

However, in the modern world, recessions are more likely to occur when there is a decline in the amount of money being spent by consumers. A recession is also likely to occur when there is a decrease in the amount of business investment.

Economic Downturn

Job loss during a recession happens mainly because people are unable to spend money due to their lack of income.

As a result, there is less demand for goods and services. When this happens, businesses have to reduce the number of employees they have. Many employers have to reduce the hours that their workers work.

In addition, Some companies may close down completely because they don’t have enough money to operate. It is possible for you to find a job during a recession, but it is difficult to do.

Importantly, Your best option is to look for a job in the private sector. It is easier to find a job in the private sector compared to the public sector. If you want to be successful, you should start looking for a job right now. You should find out if there are any job openings in your field of study. If you are lucky, you can find a job that offers a decent wage.

Technology Advancement

One of the main reasons for the high unemployment rate is the fast rate of technological advancement. New technologies keep coming out and they are being applied at a rapid pace.

In addition, These innovations help to bring new opportunities for people, but they also have a negative impact on employment. Many companies do not realize that they need to invest in technology in order to survive. Most of them are afraid that investing in technology will result in higher costs and will reduce their profits.

However, many employees are unaware that their job is at risk because they are not getting up-to-date with the latest developments. They believe that their jobs are safe and they do not consider that they may lose their jobs at any time. Most employees are still willing to accept lower wages in exchange for job security.

Lack of Business Diversity

Businesses that have diversified their business are not vulnerable to job loss. These companies have a wider array of products and services that they can turn to if sales begin to decline.

Further, They are not only able to turn to their core business, but they can also diversify to different types of businesses and other areas of operation as well. If a business starts to see a decline in sales, they should make sure that they have diversified enough to prevent job loss.

Moreover, Businesses that have diversified are usually able to withstand a downturn in sales. They are not as likely to have to layoff staff or cut costs. They can also afford to wait out a recession until sales rebound.

Outsourcing and Offshoring

Outsourcing or offshore means that some of your company’s functions are moved from your current location to another country. Outsourcing is the practice of taking a function and moving it to another location where it can be performed at a lower cost.

In addition, Outsourcing and offshoring are practices that have become increasingly popular over the years. Companies may outsource or offshore some of their functions to countries where labor is cheaper, which reduces their operating costs.

However, during a recession, these practices can contribute to job loss as companies may decide to move their operations overseas to cut costs.

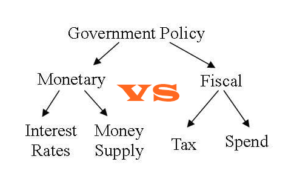

Fiscal and Monetary Policies

Fiscal policy refers to the ways a country can raise and lower its level of government spending, taxes, and borrowing. It includes government spending on infrastructure and social services, government borrowing, taxation, and inflation.

In addition, Fiscal policy also includes government borrowing and lending policies that affect the government’s access to capital markets. Monetary policy refers to the actions a central bank takes to control the supply of money.

Moreover, The central bank controls the total amount of money that circulates in a country by deciding how much money banks issue to one another, by determining the interest rate on deposits, and by controlling the exchange rate.

Budget deficits can be a sign of fiscal policy going wrong. Budget deficits occur when the government spends more than it receives in revenue. A budget deficit can lead to increases in government debt, which is a situation that can become dangerous.

Jobs most likely to be cut in a recession

As a general rule of thumb, jobs that are non-essential will likely be cut first when times are tough. Most people are looking for ways to save money these days, so they might be looking to cut back on their expenses in order to increase their savings. Jobs that are considered non-essential include those that aren’t essential for our daily lives.

Additionally, this is true for many businesses. Jobs that aren’t essential to our daily lives include jobs that people don’t think about, like jobs that are in the retail industry or hospitality industry. Jobs in the manufacturing sector are also going to be cut. A lot of manufacturers are downsizing. Many are using outsourcing as a way to cut costs. This means that they will be using more temporary and part-time workers.

Hospitality and Tourism

Some of the major tourism-related companies include airlines, cruise lines, theme parks, and hotels. These companies provide accommodation and transportation for tourists.

In addition, When a recession happens, people tend to cut back on non-essential spending. Thus, hotel chains, restaurants, and other hospitality businesses may be the first to experience a decline in revenue.

Moreover, Because these companies offer an essential service, they often find it difficult to survive through a recession. Many of them try to cut costs by laying off staff. As a result, hotel chains, restaurants, and other hospitality businesses may suffer.

Retail

Retail jobs are also at high risk during a recession. As consumers cut back on spending, many retailers will experience a decline in sales. In turn, retailers may need to cut costs by reducing staff or even closing stores.

However, While some retailers, such as discount and dollar stores, may fare better during a recession, others, such as luxury retailers, may be hit particularly hard.

Further, In recent years, the number of retail jobs has been growing. According to the Bureau of Labor Statistics, retail employment rose 3.0 percent between May 2010 and May 2011. Between September 2008 and July 2009, retail employment fell 11.0 percent.

Manufacturing

The manufacturing sector is also susceptible to job losses during a recession. It is important to note that manufacturing jobs are especially susceptible to being outsourced. Companies do this because it allows them to save money.

In addition, When a company moves its operations overseas, they usually save money. This can result in layoffs and even bankruptcy. Many times, a company will move its operations to a country with lower labor costs. The process is called outsourcing.

Further, When companies move their manufacturing to countries with low wages, they are doing this because they can save money on labor costs. As a result, this will lead to layoffs and a decrease in the number of jobs available. This may affect individuals who are in the manufacturing sector.

Financial Services

When the economy goes through a recession, financial services industries are not immune to its effects. As businesses reduce their spending, many financial services companies cannot meet their customers’ needs.

In addition, This leads to fewer financial services jobs. There are more people than ever before who are looking to finance their personal and business lives. When a recession hits, people often find themselves in trouble because they can’t afford to pay their bills.

Further, A recession is a time when many people find that they are having financial difficulties. Many of these people look for ways to borrow money to solve their financial problems. Businesses also need to finance their operations. If they can’t get enough money, they will have to cut back their spending.

Automotive

The automotive industry is also at high risk of job losses during a recession. Consumers are cutting back on spending. As they reduce their buying, they may postpone or cancel new car purchases.

Moreover, That means fewer cars will be produced and there will be a shortage of vehicles. It will be difficult to find a new car for sale when there are fewer vehicles on the road.

In addition, This situation can cause problems for the auto industry. The auto companies will be forced to cut back on hiring and production. Many people will lose their jobs as a result of the decrease in car sales.

However, The auto industry is also at high risk of job losses during a recession. There will be fewer cars available for purchase, and those cars will cost more.

Advertising and Marketing

Advertising and marketing companies rely on advertising and marketing campaigns to generate revenue. If their spending decreases, the companies may have to cut back on their advertising and marketing campaigns. This can mean a decrease in revenue for these firms, and as a result, job cuts.

In addition, Job cuts can be especially devastating for advertising and marketing firms, since they often depend on skilled workers. Workers in advertising and marketing jobs usually work long hours and put in long hours to produce effective advertising and marketing campaigns.

Further, When a recession hits, workers in these jobs have less money to spend on themselves and their families. This can cause them to miss work or ask for unpaid leave from their jobs.

Construction

The construction industry is another sector that is often hit hard by a recession. As consumers cut back on spending, they may delay or cancel home renovations or new home purchases.

However, This decline in demand can lead to a decrease in construction projects, which can result in job losses for construction workers.

Conclusion

During an economic downturn, many businesses may face financial challenges that require them to cut costs. Unfortunately, one of the most common ways to reduce costs is to lay off employees, which can be a difficult and painful process for both employers and workers.

In addition, Some jobs are more likely to be cut in a recession than others. For example, jobs in the retail, hospitality, and travel industries may be at higher risk because consumer spending tends to decrease during a recession.

Similarly, jobs in the manufacturing and construction sectors may also be vulnerable because demand for goods and services may decrease.

However, it’s important to note that not all jobs are equally at risk during a recession. Some industries may actually experience growth, and there may be opportunities for workers with in-demand skills to find new employment.

Moreover, Workers can prepare for a potential recession by building their skills and diversifying their job search. By staying informed and taking proactive steps to adapt, workers can increase their chances of weathering an economic downturn and emerging stronger on the other side.